tax sheltered annuity calculator

With this calculator you can find several things. Dear Allen If you were born before Jan.

Annuity Taxation How Various Annuities Are Taxed

A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt.

. If you want to know more about the tax status of annuities you may also use a free online calculator. It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they are withdrawn from the. How Does a Tax Sheltered Annuity Work.

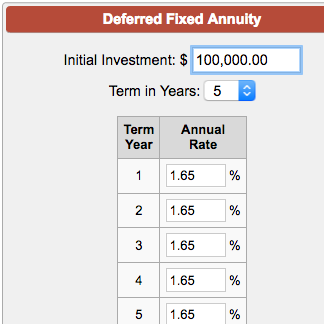

Understanding a Tax-Sheltered Annuity. Annuity Contract Holders Get answers to questions. A Fixed Annuity can provide a very secure tax-deferred investment.

It is also known as a 403b retirement plan and. Ad Help Fund Your Retirement Goals with an Annuity from Fidelity. IRC 403 b Tax-Sheltered Annuity Plans.

An annuity start date is the date on which your annuity payments will begin. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account. Retirement Age Calculator.

The withholding rules apply to the taxable part of payments from an employer pension annuity. The excise tax doesnt apply to. Without a 401 k deduction the taxpayer would have a federal tax obligation of 44000 200000 022 44000.

Generally pension and annuity payments are subject to Federal income tax withholding. 403b Calculator A tax-sheltered annuity TSA also referred to. 2 1936 and the lump-sum distribution is from a qualified retirement annuity you may be able to elect up to five optional methods of.

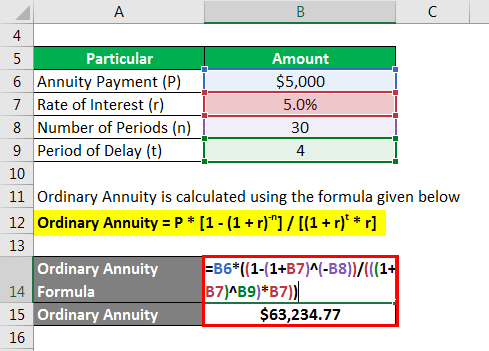

An annuity is an investment that provides a series of payments in exchange for an initial lump sum. Use this calculator to see how increasing your contributions to a 401k 403b or 457 plan can affect your paycheck as well as your retirement savings. The insurance company determines that you have a 20-year life expectancy and promises to pay you 565 a month for the rest of your life.

A tax-sheltered annuity TSA is a retirement savings plan that allows employees to invest pre-tax dollars in an account to build. This calculator uses the. The Annuity Calculator is intended for use involving the accumulation phase of an annuity and shows.

The most common tax-sheltered. How To Transfer Your 403b To Another Account. Click Play to Play the Hero Carousel Content Click Pause to Pause the Hero Carousel Content.

Your initial 100000 investment is expected to grow. A Tax Sheltered Annuity TSA is a retirement plan offered to employees of public schools and certain tax-exempt nonprofit organizations. The free online calculators will take the years of your annuity payments into.

ERISA Coverage Of IRC 403b. By Retirement Advisor Aug 16 2022 2 Comments. If your 403b account invests in mutual funds and you exceed your limit on annual additions you may be subject to a 6 excise tax on the excess contribution.

However if the taxpayer contributes fully to a traditional 401 k.

Should You Pay For A Retirement Calculator Can I Retire Yet

900 Annuities Clip Art Royalty Free Gograph

Best Retirement Calculator To Determine Future Savings And Income

Annuity Interest Rate Calculator Find Your Apr New York Life

2022 Tax Planning Strategies Nationwide Financial

Deferred Annuity Formula Calculator Example With Excel Template

Retirement Accounts A Comprehensive Guide Meld Financial

Tax Sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits

A Tax Deferred Annuity 101 Guide For Non Biased Consumers Due

Taxable Income Formula Calculator Examples With Excel Template

Inherited Annuity Tax Guide For Beneficiaries

Annuity Taxation Fisher Investments

Deferred Fixed Annuity Calculator

How Much Would A 2 Million Annuity Pay Smartasset

![]()

What Is A 403 B Is A Tax Sheltered Annuity A Good Idea

:max_bytes(150000):strip_icc()/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)